Millennials and Gen Z are puzzled, discouraged and pessimistic about the future: Without secure jobs, steady pay raises, and company pensions in the New Normal, how can they possibly afford to retire? Especially since Financial Planners insist they’ll need five times their annual income in “the bank” (saving and Investment accounts) at retirement!

It’s impossible to scrimp that much from the monthly budget. Even fully funded 401(k) plan, Roth IRA, and similar accounts are no guarantee. The stock market can go into a prolonged slump at the worst time. Home appreciation looks good on paper but isn’t real until cashed in, and presuming the market doesn’t go into a slump first.

This is not only a financial problem, it’s a personal and emotional one as well, weighing heavily on them. Like Alice in Wonderland, they’re running as fast as they can but don’t seem to be getting anywhere. It’s no wonder they’re not optimistic, stressed and anxious by the uncertainty of it all.

This isn’t the first time Americans have faced stagnant wages and lack of company pensions. Thankfully, earlier generations came up with a practical solution that could be employed today. Simply put, there’s an old idea that’ll serve as a fresh approach to funding retirement today. The purpose of this web site is to share it with you.

Fresh Approach

The solution starts with taking a fresh approach to the nature of the problem. Searching for more money won’t lead to a solution, finding more time will. In other words, instead of budgeting your salary better, the solution is to budget your career better.

In the Old Normal, people could spend their entire career on mortgage payments, interest expense, because they had steady pay raises and company pensions. Time was on their side! All they needed was a rainy-day fund.

Without company pensions, however, people need more than a rainy-day fund, they need a real retirement account. Unfortunately, without real and steady pay raises, there will never be enough extra money to build one. The only sensible alternative is to eliminate time and money spent on monthly payments that are mostly interest expense, and redirect limited earnings into investment capital. None bigger than the monthly mortgage payment, the first 10-15 years of which are overwhelmingly interest expense.

Given a 40 year career (at best), no more than 20-25 years can be allocated to mortgage payments in the New Normal, leaving the last 15 years of career to invest in yourself, investment capital for a retirement account. This is the essence of the “Nest Egg Strategy.”

Former mortgage payments are the ideal amount of investment capital for a retirement account, because they usually reflect a homeowner’s income and standard of living. Not surprising, the resulting retirement account will likewise reflect the amount they need to support that standard of living in retirement.

The Nest Egg Strategy is not a new idea but a renewed one It’s what generations prior to the industrial boom that followed WW II did, before employers provided Defined-Benefit pension plans! Everyone aimed to pay off the mortgage as soon as possible, so the rest of their careers could be used for a retirement account.

It’s time for Millennials and Gen Z to walk in their footsteps. Simply put, it’s time to budget their careers differently in the New Normal.

20 Years in Retirement

Millennials and Gen Z are expected to live a good 20+ years past age 65. Earlier generations were expected to live about 10 years after retirement, so 10 years of former mortgage payments was good enough. Living longer, Millennials and Gen Z will need to transform 15 years of former mortgage payments into investment capital. Hence the reason why the mortgage should now be paid off by age 50-55 in the New Normal.

A retirement account built on 15 years of former mortgage payments will build an account that five times annual income, which is precisely the amount Financial Planners insist everyone have “in the bank” at retirement. And for good reason.

A 5X retirement account can pay half of living expenses for 20 years in retirement. Social Security and other income, 401(k) in particular, will pay the other half. Between them, even without a company pension plan, Millennials and Gen Z can maintain their lifestyle and standard of living in retirement.

Time is indeed money. Saving time by reallocating your career is the solution to the retirement puzzle!

Paying off by age 50-55 (no matter how many times the homeowner moves) seems impossible, at first blush.

Without substantial pay raises, where is that much extra money coming from? The confusion is most people think they need to make 180 extra mortgage payments. Not so! Thankfully, they only need to repay the principal scheduled for those 180 payments, which is a small fraction of the monthly payment.

That’s because a 30-year mortgage is front-loaded with a preponderance of interest expense. (People aren’t buying a home during the first 10-15 years as much as renting money.) The good news is there’s so little principal in the monthly payment that it takes only a small amount to “buy back” all that time from the repayment schedule. In other words, give back the principal, and the lender will give back the time.

For example, if Millennials and Gen Z repay the principal scheduled for 10 years in only 6 calendar months, the other 9 1/2 years of scheduled payments disappear. Presto!

Do it time and again over the next couple of years and recapturing 15 years of scheduled payments is a reasonable expectation. A homeowner who is 35, for instance, can be mortgage-free by age 50-55.

Sadly, many people miss out on this opportunity for two reasons, (1) they think they need to make 180 extra mortgage payments, and (2) they think the original schedule is a requirement, not realizing it’s only a list of minimum payments.

Thus, recapturing 15 years of your career is not only realistic but it’s one of the best investments you can make.

For more insights, see https://www.nesteggstrategy.com/Strategic-Repayment

Tip from the old-timers: Never try to repay principal or any other investment with money left over from the monthly paycheck – there’s never anything left over!

The secret is to write the first check to “these investments.” This is known as the “Pay Yourself First” principle. This tenet comes from the famous book, “Richest Man in Babylon,” by George Clason, published in 1933, and still in print today. (Dale Carnegie Institute ranks it among the “most important business preachments of modern times.”)

Re-Allocate Career

Time is the only resource there isn’t enough of. Once it’s gone, it’s gone forever. This makes time more precious than money.

Therefore, the secret isn’t the best way to budget your money but best way to budget your 40-year career (at best). How much can be allocated to repaying debt on big acquisitions, and how much should be reserved to invest in yourself.?

Since we know that 15 years of former mortgage payment is the magical amount for a retirement account that can pay half of living expenses for 20 years in retirement, it means a maximum of 25 years can be spent on mortgage and other big monthly payments. (Those already 5 years into payments have got 20 years left.)

In the Old Normal, your parents and grandparents could spent their entire career on mortgage payments because they had company pensions. All they needed was a rainy-day fund, and equity in their homes. That’s not true for Millennials and Gen Z with ordinary jobs, since they’re deprived of both company pensions and steady pay raises.

If they’re going to end up with any money at the end of their career, they can’t spend all of it on monthly payments, especially those with a lot of interest expense. They need to leave time and money to invest in themselves. Not just any amount of time and money but 15 years of former mortgage payments!

Fifteen years is the magic number for Millennials and Gen Z because it will build a retirement account that’s five times annual income, big enough to pay half of living expenses for 20 years in retirement, until age 85. With the other half paid by Social Security and other income, Millennials and Generation Z can retire in comfort.

Eureka!

Crucial turn of events – transforming former mortgage payments into investment capital turns the tables on “compounding” – instead of paying compound interest, you start earning compound income! All together, after 20 years of monthly withdrawals, compound earnings will account for half of all the money paid out. In other words, half of living expenses will come from former mortgage payments while the other half will come from compound earnings.

“Time-Value of Money”- it’s either working for or against you. Either you must run as fast as you can to keep up or earn money while asleep. Earning while sleeping is better!

Nest Egg Strategy

Saving 15 years of career to invest in yourself, the “Nest Egg Strategy,” may be a simple idea but the best ideas are always simple! That’s because the truth is always simple.

Complex problems are often resolved by simple solutions. There’s even a law for it, “Occam’s Razor: The simplest solution is usually the right solution.”

The simple truth is there’s been a sea change between the Old and New Normals. Filtering down to the individual level, it means a change in how home ownership fits into their long term financial planning. The Nest Egg Strategy isn’t just an accounting tactic, it’s an overarching adjustment that puts average homeowners into the flow of where the New Normal is headed.

Those in science, medicine, and technology, as well as the professions, people with steady pay raises and guaranteed pensions can continue as before. Average people with ordinary jobs, however, need a re-vision, a course correction.

Why?

A) Demise of company pension plans for people with ordinary jobs, complicated by end of secure jobs and pay raises higher than increases in cost of living.

B) Tide no longer lifting all boats, not providing greater income to pay the debt on big-ticket acquisitions. “Borrow-dear, repay-cheap” is now the exception, not the rule.

C) Living twice as long as earlier generations, Millennials and Gen Z will need a retirement account that can provide half of living expenses for 20 years in retirement, until age 85, supplemented by Social Security and other retirement income.

D) A retirement account that’s five times their annual income will be needed to provide that much money for that long.

E) Less of limited income used on mortgage payments, especially interest expense, will the source of funds for that retirement account.

F) If 15 years of career are preserved for saving and investment accounts, no more than 20-25 years of career can be allocated to mortgage payments.

G) The mortgage needs to be paid off by age 50-55 in the New Normal.

Indeed, no high flaunting economic analysis is needed to realize there’s been a sea change between the Old and New Normals. Or, that continuing to pursue the old borrow-dear, repay-cheap strategy in the New Normal will rob many people of the time and money to build a retirement account of their own. It’s time for them to take the “road less traveled,” one that will make all the difference.

Owning a home is still a great investment. All the more so with a retirement account of your own. Then, the resale value of your home (appreciation) becomes icing on the cake.

As noted, the Nest Egg Strategy is an overarching adjustment that puts average homeowners into the flow of where the New Normal is headed. In the Old Normal, one could get ahead by the clever management of debt. In the New Normal, building equity and earning income is the way for average people to get ahead. Instead of trying to mitigate the cost of interest expense in the Old Normal, the strategy in the New Normal is to earn compound income.

Compound Income Makes All the Difference

“Time-Value of Money” means that compounding is either working for or against you. During first 10-15 years of payments on a 30-year mortgage, compound interest expense is strongly against you. In contrast, earning compound income on a retirement account is working much harder than most people imagine.

People fail to realize the power of compound earnings because they’re fooled by a “low” earnings rate. They forget that earning income on top of previous income multiples the balance quicker than the annual rate would indicate. (One reason why Albert Einstein thought compounding was the 8th wonder of the World.)

In our example, half of monthly withdrawals (living expense) over 20 years in retirement will be due to compound earnings. These earnings are not just on the former mortgage payments but interest earned on previous income as well.

These compound earnings come in two phases:

First phase is compound earnings during the 15 years the saving and investment accounts were being built. In fact, one-third of the 5X account will be due to compound earnings. Second phase is compound income on the retirement account during the next 20 years of monthly withdrawals Between the two phases, compound earnings will account for nearly half of living expenses paid out in retirement.

Simply put, it’s better to earn income while you sleep than working as hard as you can to keep up with interest expense.

No fancy whiz-bang, the Nest Egg Strategy is just simple arithmetic that puts the time-value of money in your favor.

Recap: 15 years of former mortgage payments + compound income = 5X annual income = 50 % of living expenses = 20 years of retirement. The truth is always simple!

Proof: Median household income in 2023 was $6,167 per month, about $5,000 after payroll taxes. This means they can pay about $1,500 per month in Principal & Interest payment (plus taxes and insurance). Depositing former mortgage payments of $1,500 K for 180 months, earning a mere 4 percent, will build a $394,000 retirement account. Which is 5.3 X of a $74 K annual income. (At 8 percent, it’ll amount to $599, 000.)

A $394 K account will permit withdraws of $2,560 per month for 20 years. Given that this homeowner is not paying payroll or SS taxes, that’s about half of their actual $5,000 per month living expenses. (Earning 8 %, withdrawals will be $5,526 per month). Bingo!

The Nest Egg Strategy is such a profound change from conventional wisdom that there will be many Yeah, But … arguments against the notion of paying off the mortgage by age 50-55. Which is only natural. Anything that challenges a game-plan that worked so well in the Old Normal will immediately draw objections – at first.

Yeah, But …

It’s only natural to question changes to a strategy that worked so well for so long, especially when it concerns one’s home, and their money. In other words, question conventional wisdom.

It worked for so long that it’s assumed the underlying circumstances will continue the way they have for so long in the past. But, they haven’t! Some are now less true than they were, and some have become downright counterproductive in the New Normal.

“Conventional wisdom” is the last to recognize these changes, so close to the trees that it can’t see the forest. The sub-prime mortgage fiasco of 2008 is a prime example of being too close to the trees.

Popular Yeah, But … Arguments:

But, I’ll repay with cheaper dollars.

But I can’t afford to pay off the mortgage by age 50-55.

But, my 401(k) plan and home appreciation are all I need.

But, I need the tax deduction.

But, I plan to move to new house in five years.

But, appreciation will make up for the interest expense.

But, shouldn’t I keep a low mortgage.

But, money in the house is idle equity.

But, isn’t the stock market a better investment.

But, stretching it out is only way to afford monthly payment.

But, “gotta buy now” or never.

The top two arguments are the most common objections. After all, a rising tide used to lift all boats, making expensive monthly payments cheaper over time. Steady pay raises let everyone borrow-dear, and repay-cheap.

This is still true for those in science, medicine, and technology, along with finance, law, and other professions. It’s no longer true for average people with ordinary jobs, however, because they aren’t getting pay raises higher than Cost of Living increases, i.e. “real” pay raises. Ergo, they can’t repay “cheap.”

This isn’t a temporary situation. The Corporate philosophy has changed, led by the top Business Schools. They no longer think it’s their mandate is to raise the standard of living of ordinary employees. Nor, to consider the effect of their operations on the local community.

Conventional wisdom fails to recognize this change. Maximizing profits has become the only responsibility of corporate officers, and focus of the investment community. Accordingly, even though profits have soared, “real wages” have been stagnant for decades. Indeed, Wall Street would fire any CEO the next day if they tried to increase wages commensurate with profits.

It wasn’t always this way. Philosophy after the Great Depression and WW II was “everyone is better off when working people are better off.” Which manifest itself in company pensions for ordinary employees, as well.

Ultimately, the “bean counters” decided that an obligation for defined-benefits 20-30 years down the road was more than companies should risk. So, corporations switched to a one-time contribution to a 401(k) plan, absolving them from any further obligations.

Two problems First, only 1/3rd of employees fully fund these 401(k) plans. The idea may look good on paper, but many people will fall short of what they’ll need for retirement. Second, there’s no guarantee the Stock Market will be strong when its time to retire. Worse, it might even suffer a crash from excessive exuberance on dubious “instruments,” as it did in 2008.

Although a 401(k) is a prudent choice, it’s not a sure thing when it comes to paying half of living expenses during 20 years of retirement. Rather than “putting all your marbles” on a 401(K) plan, better it be a complement and supplement to a “cash nest egg,” money in the bank.

Yet, despite all that has happened, all the King’s Horses and all the King’s Men still give the same advice they did back when ordinary employees had real pay raises and company pensions. They pretend not to know the New Normal has made that advice obsolete, and that’s it’s here to stay. Worse, they’re silent on a replacement for the borrow-dear, repay-cheap strategy to retirement.

They apparently don’t want to rattle the real estate industry, their bread and butter. After all, the industry can make more money when people pay interest expense and make mortgage payments for their entire careers.

Indeed, since a benevolent economy and employers aren’t going to look out for Millennials and Gen Z, they need to look out for themselves. Simply put, they need to leave time and money from a limited career to invest in themselves!

The second biggest objection is they can’t afford to pay off the mortgage by age 50-55. As noted previously, they mistakenly assume they’ll have to make as many as 180 extra mortgage payments, in order to eliminate 15 years of payments. Not true! They only need to “prepay” the principal scheduled for those payments, which is only a tiny fraction of the normal payment.

Pay that principal ahead of schedule and all those payments automatically fall off the repayment schedule. The next monthly payment jumps ahead to the balance listed on the repayment schedule. Leapfrogging forward, a 35-year old homeowner can indeed pay it off by age 50-55.

Taking the first step on the road less traveled is the hardest. After the first couple of steps, firmly on the path, you’ll see that many travelers have gone before you.

PS: There’s a grain of truth in many of the other Yeah, But .. arguments. But none so big that it invalidates the Nest Egg Strategy. Once again, it’s a matter of balance. Liberate 15 years of mortgage payments, and also take a tax deduction on the normal monthly payment, for instance. Each argument must be evaluated on its own merits and relative to one’s personal situation.

See a critique of each “Yeah But …” argument at http://www.nesteggstrategy.www/yeah-but

Sacred Space

In addition to financial rewards, the Nest Egg Strategy provides personal, emotional and psychological benefits that many believe to be even more important. It’ll restore hope and optimism to young people for a brighter future, lifting a cloud off their hearts and minds.

That’s not surprising since home is far more than a mere dwelling or financial investment. It’s your refuge and sanctuary. Refuge keeps the dark aspects of the world out, while sanctuary lets the best of earthly delights in. Both of which are key to one’s health and happiness.

After all, home is where life is celebrated with family and friends, where you’re blessed by sweetness, beauty, and love! It’s where you get rest and recreation essential to restoring your vim and vigor. It’s where you enjoy peace beyond measure! And where your children enjoy love so deep their hopes shall remain forever unbounded!

If a reverence for something makes it sacred, “Home is indeed Sacred Space!“

(See Home as Sacred Space.org for bigger exploration.

A Pound of Crop

Farmers are fond of saying “a pound of crop is worth a ton of theory.” The “pound of crop” in this case is the amount of money it’ll actually mean to you, the size of retirement account you can expect for transforming 15 years of former mortgage payments into investment capital. Furthermore, how much you can withdraw every month in retirement.

Use the online calculators, found on the tab above, to learn both answers. (You can change all the variables, such as number of former mortgage payments, the earnings rate, or how long you want the account to last, for example.) (Link to calculators)

No personal or financial information is collected, saved, sold or otherwise infringe on your privacy. (The data cannot even be carried from one calculator to another. You must input the data manually.)

Donate: These calculators are provided as a community service. To help offset the upkeep and maintenance of this web site, a small donation would be appreciated. You can make a one-time $8 donation via PayPal/Donate. (PayPal/Donate is the only entity that knows your identity and captures your payment information.)

Banking on Appreciation

Extraordinary, unparalleled, home appreciation will tempt many people to bank on it for retirement, rather than adopt the Nest Egg Strategy. After all, why go through all that trouble when home appreciation is free, “happens by itself,” and with no effort.

Actually, it’s because appreciation is better as icing on the cake, than the cake itself. For one, it’s unreliable. You can’t count on it 20 years down the road. For another, it’s fickle, it goes up and down out of your control, and happens without notice. Not least, and importantly, you can’t spend it at the local grocery store. In contrast, with a cash nest egg of your own, and with living expenses taken care of, you can save appreciation for travel and vacations, along with spoiling the grand kids!

Indeed, appreciation equity looks good on paper but it isn’t real until it can be actually cashed in, which may take many years.

Furthermore, when you can influence factors that promise to improve the results of an endeavor, it’s a calculated “risk.” When you can’t, when you don’t even know what the factors are, let alone influence them, it’s a “gamble.” Thus, since appreciation goes up and down for mysterious reasons, which out of your control, it’s not a calculated risk but an outright gamble. In other words, retirement will depend on good luck!

Furthermore, people are overly optimistic if they think a 10-15 percent appreciation rate can be sustained. A sustainable rate is two points over the inflation rate, its behavior over the past century. Supply and demand may be so out of balance now that prices are out of whack. Although this shall not last.

Sooner or later, it’ll get back in line with the earning power of homeowners. With pay raises at only 2-3 percent, expecting more than 4-5 percent is unreasonable. The only question is whether current home prices will enjoy a soft landing or go through a “crash” first. Which the Federal Reserve is keeping an eye on, aiming to effect a soft landing. Will it, who knows?

Another downside is those who leverage to the max, thinking they’ll gain the most appreciation, could find themselves “underwater,” owe more than the house is worth should the market experience a dramatic fall, which it has done many times before. They’re at risk of foreclosure, losing everything.

The irony is leverage has nothing to do with appreciation, let alone maximizing it. Those who do are following the wrong star. The amount of appreciation is entirely a function of the market in your neighborhood. It doesn’t matter whether you financed 90 percent or own the house free and clear, the dollar amount of appreciation will be exactly the same. You won’t lose a penny for paying down the mortgage sooner than scheduled.

Why go out on a limb when there’s nothing to be gained by leveraging a mortgage to the max? Similarly, why be nervous, stressed, biting your bottom lip for years on end when it doesn’t add a single dollar to your financial statement!

Indeed, with a retirement account of your own, appreciation is icing on the cake!

About Us

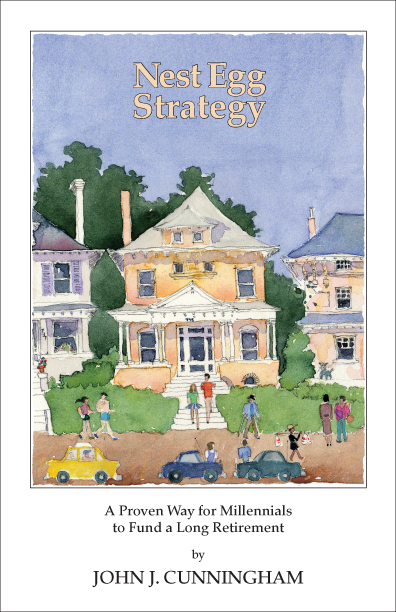

The Nest Egg Strategy was “re-discovered” by John Cunningham, a financial consultant in commercial real estate projects with more than 30 years of experience in solving financial riddles and mysteries.

It all started back in 1990 when John discovered the “true cost” during the first 10-15 years of scheduled mortgage payments was actually 10 times higher than the stated interest rate, when measured on a cash basis. That is, if there was $10 of interest for every $1 principal during in the front of the repayment schedule, it meant it’s true cost was 1,000 percent to repay that $1 of principal, irrespective of the annual interest rate. Therefore, the aim was to eliminate as many of these payments as possible.

To that end, John published “Unscramble Your Nest Egg,” which offered a unique “principal acceleration” plan based on the actual distribution of interest expense, not the stated interest rate. Attacking it that way, the “Cunningham Plan” was far more effective than typical mortgage “prepayment” plans.

Since then, with the retirement plight of Millennials and Gen Z, the aim shifted from “saving” exorbitant interest expense to liberating 15 years of mortgage payments for investment capital. In other words, the focus shifted from the front of the repayment schedule to liberating the 15 years of payments from the back, so the time and money could be used for a retirement account.

Rather than making a business out of it, John decided to share it as a community service. In addition to a book on Amazon, “Nest Egg Strategy,” he created this web site so Millennials and Gen Z would have easy access and pass it along to their friends. Finally, and importantly, they could use the online calculators to learn “what’s in it for them.”

Printed books are a thing of beauty, but web sites can fly through the air at the speed of electricity.

Even though everything you need to know is contained in this web site, many people would like to know more detail. Hence, a 115 page book, “Nest Egg Strategy.”

Three topics are greatly expanded: (1) Detailed explanation of how an amortized mortgage is actually put together, so you know how to take it apart. (2) Reasons why the New Normal isn’t going back to the Old Normal. (3) Customs and traditions that reflect home as a refuge and sanctuary, sacred space.

(Available on Amazon online, or bookstores via Ingram.)

Book

“This book could go a long way to easing America’s retirement challenge. Well written and wise.” Honorable Richard D. Lamm, Former Governor or Colorado

Donate

There is no charge for using these calculators, or any other aspect of this web site. They’re free, offered as a community service. A small donation to help offset the upkeep and maintenance of this web site would be appreciated, though. You can make a one-time $8 donation via PayPal/Donate. (PayPal/Donate is the only entity that knows your identity and captures your payment information.)

Thanks!

(PayPal Donate is only one with access to credit card and personal information.)

“Toot Your Horn.”

How the Millennial Generation and Gen Z “goes” in the coming decades, especially for those who “work for a living,” is indeed how the entire country will go.

People need money in their pocket to feel like they’ve got a stake in the future of Democracy. Otherwise, it’s every man for themselves.

Link your friends and family to this web site. They’ll be astonished how much their mortgage payments are worth as “alternative earnings,” a cash nest egg for retirement. This will bring renewed hope and optimism for the future!

Disclaimer: Note: This website is used with the understanding that it does not constitute financial, legal, accounting, or professional advice. Although the data should prove useful, neither we or any party assumes liability for the accuracy, merchantability, or fitness of this data. All warranties, expressed or implied, are excluded.